– By Meghashyam Sinkar

The general definition of risk in dictionary is : ‘a situation involving exposure to danger.’

However ,Risk in investment decisions is defined as the possibility that what is actually earned as return could be different from what is expected to be earned .

The definition talks the possibility of “deviation”. Deviations from expected outcomes can be positive or negative : Both are considered to be risky .

Let me share a simple day to day example quoted by my mentor . The elevator in any building is “expected” to halt at the same level as that of particular floor . However , it halts slightly above the floor level it will be considered as a deviation from the expected results . And same way if it halts slightly below on another floor , will also be considered a deviation . Both the deviations contribute positively to the risk of the elevator.

Let’s explore the risk in terms of Finance.

There are two types of risk in Finance.

- Pure Risk &

- Speculative risk

Pure risk leads to financial loss, if invoked . E.g. Natural calamities like flood or earthqualke which leads to losses only and no measurable benefits .

However speculative risk will lead to either profit or loss or nothing ( no gain / no loss ) if invoked . Investing falls in this category specially in equity market .

E.g. Buying a share may lead to either profit or loss or nothing .

- How will you manage this risk in equity ?

You can either avoid it completely or reduce it . Unfortunately you cannot transfer it by buying insurance like you do with life , car , health , shop , factory , fire & many more .

Though there is a concept of hedging wherein you can limit it but you can’t completely eliminate the risk .

But can you avoid the risk ?

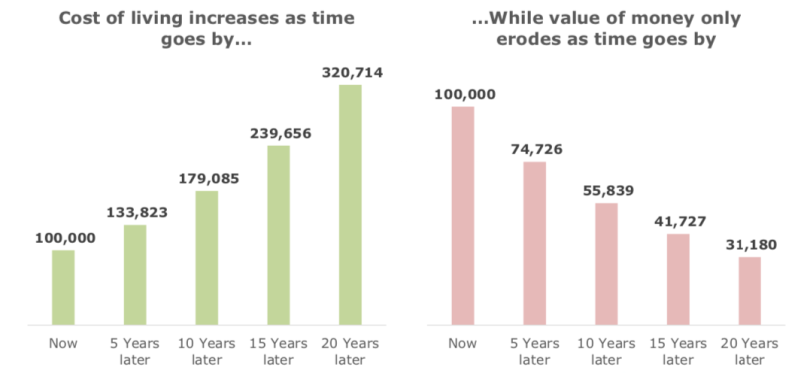

**Inflation assumed to be 6% p.a. for the above calculations for Illustration purposes.

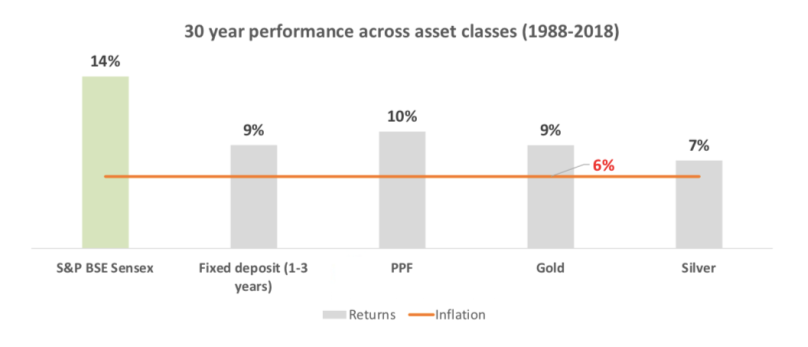

Please refer the below performance of different assets wherein equity is the clear winner over a longer time frame .

And the good part is that you can certainly manage the risk in equity .

The best way to manage is to diversify the risk . You can create the stock portfolio across all sectors if you have enough resource in terms of time , knowledge , information etc or simply invest into diversified equity mutual fund .

Now most of the investors have learned to manage the risk by investing into diversified equity mutual fund but still make losses .This is mainly because of impatience . Equity risk can be completely reduced if you invest it for minimum period of 10 years in a diversified portfolio .

Please refer the below table wherein we have taken the rolling CAGR ( Rolling returns ) across time frame i.e. 1 , 3 ,5 , 7 , 10 , 12 and 15 years . (You can refer the earlier blog on understanding the CAGR returns ; https://pentagraphcapitals.wordpress.com/2018/08/18/understanding-returns-on-investments/)

So , rolling CAGR of year means the returns you generate exactly after one year say Nov 2003 if you invested on Nov 2002 which is 74.29 % , returns on Nov 2008 if invested on Nov 2007 which is -55.98% & so on .

Similarly for 3 yrs like rolling CAGR on Nov 2003 if invested on Nov 2000 which is 11.57 % , Nov 2008 if invested on Nov 2005 which is -3.74 % .

And for 10 years like returns on Nov 2008 if invested on Nov 1998 which is 14.13%.

So , if you stay invested in diversified managed portfolio of mutual fund , you are unlikely to lose money . In fact you will certainly make more than inflation returns .

The easiest way to define the goals with time frame and park the funds in equity diversified mutual fund for the goals which are beyond 10 yrs and above .

Remember the great long term risk of equities is not owning them .

Happy Investing !!!

[…] For MF investors specially regular investors , it is anyways good as you can buy the units at lower price (NAV) . In fact SIP investors should pray for such periods . Because they make more money in cyclic movement of markets and make less returns if market is straight northward direction. If you are the SIP investors who have come to market after seeing the returns of 2017 – basically 1 to 2 yrs old SIP investors then continue it for more than 5-7 yrs because equity is for long term . Understand the risk in equity and learn to manage it . Read more on the risk in equity and how to manage it here . […]

LikeLike

[…] If you hold the equity index for 7 years and more , then the probability of losing money is NIL. Click here to know more on it […]

LikeLike